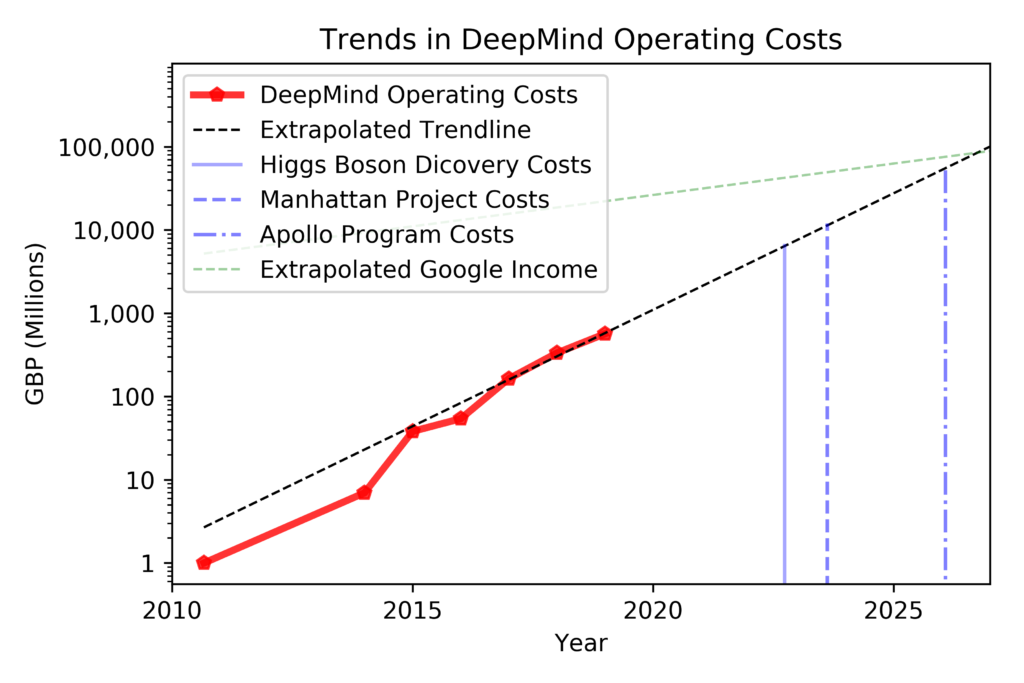

DeepMind’s 2018 financial data was made available this week. If you haven’t seen the previous DeepMind operating costs post, check it out for some context. The operating costs did not increase consistently with the previous extrapolation, however there was still a 70% increase in operating costs. I’ve updated the extrapolation and plot, and it has not changed greatly from the previous year’s model. It is depicted in Figure 1 below.

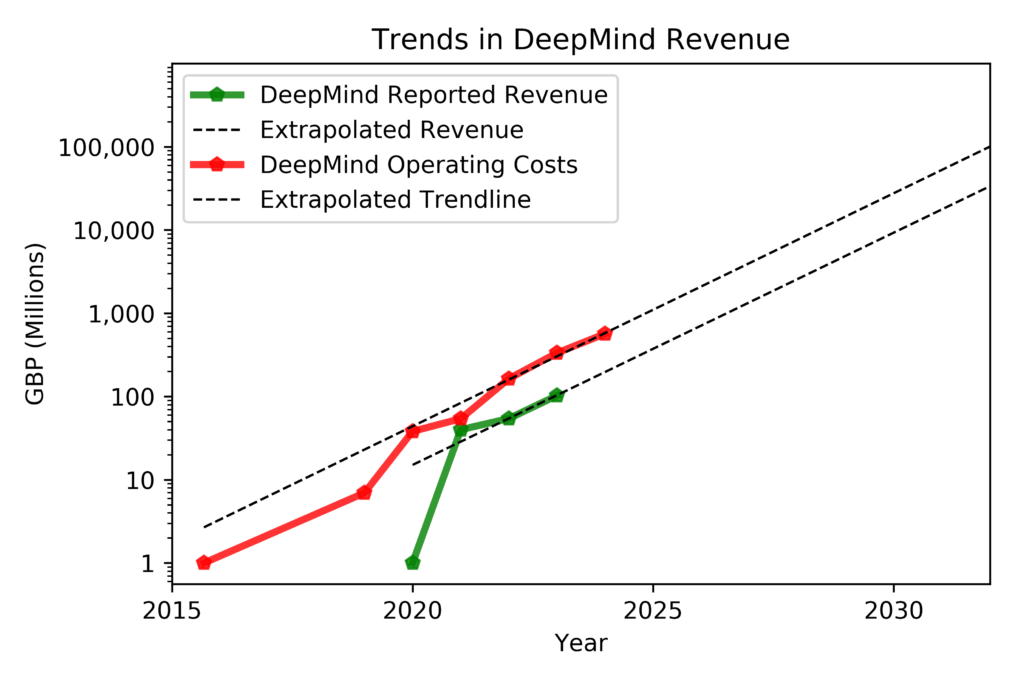

The new data also indicates that DeepMind has accumulated a large amount of debt, most of which is owed to its parent company Alphabet – I’m looking into this further. However, DeepMind’s contract revenue also continues to increase. In fact, prior to 2016, DeepMind had no revenue. In the three years since, turnover has increased to £102.8M. The data for this is shown in Figure 2 below. If revenue continues to increase at this rate, and assuming negligible interest on the debt from Alphabet, DeepMind would be able to support the current growth if they implemented a 20 month hiring and budget freeze starting on January 1st 2019. This would suggest that they could begin growing at the rate depicted here roughly one year from now, in September of 2020.

Financial matters aside, another consideration is that realistically there doesn’t seem to be enough talent to continue to fuel the expansion at the current rate. Perhaps, if a hiring freeze effectively adjusted the operating costs growth curve to fall in line with the revenue trendline, it would be more plausible that the talent of the caliber necessary for a large, well-funded brain trust could be adequately trained and experienced in order to sustain the growth.

The upshot from this seems to be that DeepMind’s financial data still appears to be a strong indicator worth monitoring for projecting progress toward transformative AI.

(Note: Further analysis is still needed, e.g. adding the projected dates for reaching levels of funding for large scale government funded projects given DeepMind’s income. Also, the current Jupyter notebook can be found here. Also see the follow-up post on DeepMind’s value to Google.)

I presume that the costs for the higgs boson, manhattan project, and apollo program are total costs, whereas the deepmind operating cost is annual. Is this fair?

The levels for the Higgs Boson, the Manhattan Project and the Apollo Program are all marked on the plot where the area under the extrapolated DeepMind operating costs is equal to their total costs (i.e. when the total DeepMind operating costs will be equal to the total costs for the comparable projects).